Create your

Panama Corporation in 3 Days

Panama Corporations

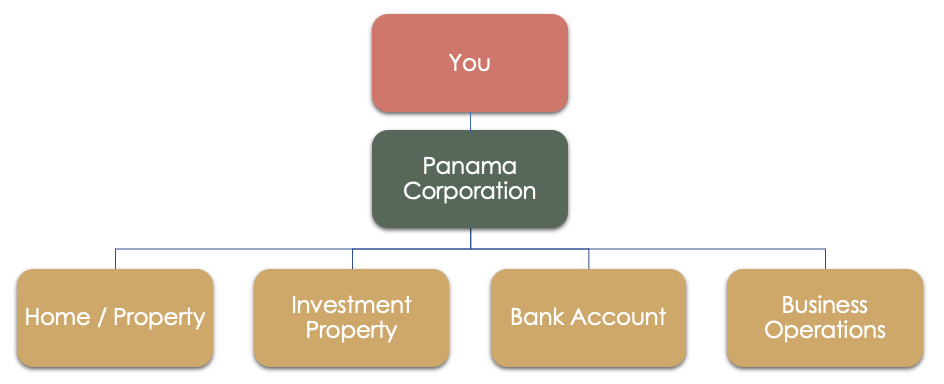

A Panama Corporation is a legal entity registered in the Public Registry of Panama, that can own and hold assets, develop business and/or just act as a paper or holding company.

The beauty of a Panama Corporation is that it can enter into contracts and own assets, separately from its owner(s).

By Panamanian Law, a Panama Corporation can exist forever. This means that if the owner dies, the company can continue as an operating entity, unlike in partnerships or sole proprietorships where company assets may be tied up in estate and taxation issues.

Why Create a Panama Corporation?

- To legitimize your business activity with a Corporate structure.

- To keep your personal assets separate from your business liabilities (Asset Protection).

- To grow a large business that you could someday sell.

- To be able to sell shares of your business.(Selling a Business in your Personal Name is practically impossible).

- To take advantage of lower corporate tax rates.

- To set up a Personal or Family for Asset Protection structure.

And many other advantages.

Our Panama Corporation Package Includes…

- Original Articles of Incorporation duly registered at the Panama Public Registry (in Spanish)

- Official Certified English Translation of Articles of Incorporation

- Panama Resident Agent Service

- Panama Registered Office

- Share certificates issued in “Nominative Form” to you or any other person or entity that you designate

- First Minutes of the Board

- Panama Corporate Franchise Taxes Paid for the first year

- General or Special Power with your name or any name you designate.

Panama Corporation Benefits

Personal Liability

If your business incurs debts or faces legal issues, your personal assets, such as your home, real estate and savings, may be at risk. But owning assets in the name of a corporation limits your exposure.

Raising Capital

Corporations and other limited liability entities often find it easier to attract investment or secure loans because investors and lenders may prefer the liability protection these structures provide. Without such protections, potential investors may be hesitant to invest.

Tax Implications

Operating as a sole proprietorship may result in less favorable tax treatment. Corporations may have the ability to deduct certain business expenses and enjoy other tax benefits that are not available to sole proprietors or general partnerships.

Perception of Professionalism

Operating as a corporation can also enhance your business’s perceived professionalism. Clients, customers, and partners prefer to work with entities that have a formal corporate structure.

Succession Planning

A sole proprietorship may face challenges in terms of continuity and succession planning. A Panama Corporations can provide a more stable framework for business continuity and transfer of ownership.

Growth

If your business grows, the lack of liability protection may limit expansion opportunities. As the scale of operations increases, the risks associated with personal liability also escalate, which is why a high degree of protection is required.

Improve Asset Protection

Panama Corporation Package Cost

$1,500 Total Fees & Government Costs, includes:

- Original Articles of Incorporation duly registered at the Panama Public Registry (in Spanish),

- Official Certified English Translation of Articles of Incorporation,

- Panama Resident Agent Service first year.

- Panama Registered Office first year,

- Share certificates issued in “Nominative Form”,

- First Minutes of the Board,

- General or Special Power with your name or any name you designate.

- Panama Corporate Franchise Taxes Paid for the first year.

- Notary and Public Registry costs

$1,300 Total Yearly Costs, includes:

- $300 – Corporate Franchise Tax

- $800 – Resident Agent Fee

- $200 – Registered Accountant Fee for non operational Entity

Order Your Panama Corporation Package Now

FAQs

Q: Do I need to come to Panama to finalize anything?

A: You do not need to come to Panama to set up a Panama Corporation. However, a meeting which can be in person or virtual is necessary to comply with “know your customer law”. Our attorneys would be more than happy to schedule a personal meeting.

Q: Can I hold personal ownership of real estate property in Panama?

A: Yes. Foreigners have the same property ownership rights as local Panamanians. You can own property under a Panama corporation for asset protection reasons.

Q: How difficult is it to transfer my money to my bank account in Panama?

A: The bank in Panama will ask for source of funds to justify that the funds are from legal sources. The bank may ask for documentation such as your tax returns, financial statements or employment letter, to support the origin of the funds.

Q: Do you provide legal consulting, for setting up specific businesses in Panama?

A: Yes, we provide legal consulting for most types of businesses. Our area of specialization is in Panama relocation, Panama immigration services, real estate law, and corporate law.

Q: What is a Panama corporation?

A: A Panama corporation is a juridical entity or juridical person, formed by law, generally by 2 or more people, which has similar rights and obligations as a person would have. A Panama corporation has Articles of Incorporation, which establishes the rules and regulations of who and how the company will operate. A Panama corporation must have 2 individuals called subscribers who appear before the Public Notary in Panama to sign the deed of formation of the Articles of Incorporation, which then gets inscribed in the Public Registry of Panama to form the juridical entity. Panama corporations require 3 individual directors to appear on the corporation, and 3 officers (President, Secretary and Treasurer), which can be 1 person occupying all 3 officer positions. The officers are the legal representatives who are authorized to sign for the corporation. The shareholders of the company are appointed on a physical share certificate that is issued once the company is “created” (once the corporation is inscribed in the Public Registry).

Panama offers various types of Panama corporations, but the most common type is what is called a “Sociedad Anonima” (Anonymous Society), which is the standard corporation formed in Panama for both local and international business use. Unlike other jurisdictions, Panama does not offer a separate type of corporation specifically for use outside of Panama. Panama corporations are either for local business use, (in which case a local business operations permit is required), or for international business use, (in which case there is no local Panama business operations permit required), or both. A Panama corporation is also sometimes referred to as an “international business corporation”, or “ibc”.

Q: What are the steps to form a Panama corporation?

A: The steps to form a Panama Corporation is generally as follows:

- Consult with Lawyer – Explain your business needs, goals and objectives, and our lawyers can provide valuable feedback and recommendations on what type of entity is best suited for your needs. We will provide a formal quotation and services agreements as well as payment instructions to proceed.

- Complete the Required Forms – Our attorneys will assist you in completing all the required forms and agreements to form a Panama corporation.

- Choose a Corporation Name(s) – On the application, you should indicate three name choices for each new Panama corporation. Panama Corporations names can be in any language and must include one of the following corporate suffixes: Inc.; Incorporated; Corp.; Corporation; S.A. Note: For your information, “S.A.” in Spanish means “Sociedad Anonima”, or “Anonymous Society”. This is just another form of saying “Corp.” or “Inc.” in Spanish.Once you have returned the application including the name(s) for your corporation(s), we will check to see if the names you selected are available in the Panamanian Public Registry. The first available name selections will be incorporated once we have received payment.

- Appoint Directors: On the application, you should indicate who you want to appoint as directors & officers of your corporation(s). Every Panama company requires 3 directors/officers (President, Secretary and Treasurer). The directors/officers can be either individuals or entities. If you are appointed as director on the Panama corporation, then your name will be publicly known as director since the directors names and identifications must be presented in the Panama public registry when the corporation is formed. Generally, the only documentation on public record is the deed (or articles) of incorporation and the names of the directors/officers and Panama Registered Agent (the registered agent is the Panama attorney or attorneys that forms the corporation).

We offer our clients the optional service of using our “Panama Nominee Directors” for their Panama corporation(s). For purposes of confidentiality and convenience, some of our clients prefer that we provide nominee directors/officers for their corporations. When we appoint Panamanian nominee directors for the entities that we establish for our clients, we always provide our clients with pre-signed, undated letters of resignation from the directors so that our client can replace those directors at any time. If clients prefer to appoint their own directors, they simply complete our order form with the names of the directors that they wish to use (they also must send us a photocopy of their directors passports and a signed authorization letter from each director to be appointed as a director).

PLEASE NOTE: We DO NOT provide Nominee Directors Services to US Persons (citizens or residents of the U.S.).

- Issue Share Certificates: On the online order form, clients should inform us as to how they wish to have their corporation share certificates issued. Currently, our law firm policy is to only form companies with Nominative shares, meaning shares that are issued to a specific name, usually the name of our client, or the name of their family trust or foundation if applicable.

- Payment: On the order form, you should indicate your preferred method of payment. After submitting the application, you will be contacted by our service staff and will be provided with payment instructions.

- Incorporation Timeline: A new Panama corporation can be established within 3-5 business days. If you wish to expedite the formation of your Panama corporation, there is a $250 expedite fee, and we can have it completed within 24 to 48 hours.

Q: What is Law 47 and Bearer Shares?

A: Panama is one of the few countries in the world that still offers “bearer shares”, which are share certificates of a corporation that are issued to the name of “The Bearer”, meaning that the owner is the “bearer” or holder of the shares. However, in August, 2013, Law 47 was passed which requires that Panama corporations issuing bearer shares and everyone in possession of those bearer shares must designate an authorized custodian to take possession of the bearer shares. An authorized custodian could be a licensed bank, a Panama attorney (or law firm), Panama fiduciaries, or brokerage houses regulated by the Superintendence of the Panama Securities Market. Additionally, those custodians in possession of bearer shares must submit a sworn declaration providing basic identity information about the true owner and the corporation which issued the shares, as well as its resident agent.

Please note that this law does not obligate Panama corporations to register the names of the shareholders at the Public Registry. Only the corporation’s officers, directors, and registered agent’s names are registered at the Public Registry.

Due to the risk associated with bearer shares, International Relocation Firm currently does NOT offer formation of Panama Corporations using bearer share certificates, we only offer formation of Panama Corporations with nominative share certificates, meaning that the shares are issued to specific persons’ name(s), or to the name of a corporation, foundation or trust.

Please note that Law 129 of March 17 of 2020 was passed by the government of Panama, to create a registry of final beneficiaries of legal entities in Panama. The law establishes that the Superintendence of Non-Financial Subjects will manage the technological system of registration of final beneficiaries of legal entities, and the officials designated by said authority will have exclusive access to the information, with the obligation to maintain strict confidentiality and privacy of said information. Once the system is implemented, all lawyers and law firms in Panama that serve as the resident agents will have a period of 6 months to register the final beneficiaries of each of the legal entities of their clients in the system (even those entities created prior to the implementation of this law), and keep the system updated periodically. While the resident agent will be responsible for keeping the information updated, the resident agent will not be responsible for the veracity or accuracy of the information provided by their client. Any entity that does not provide the final beneficiary information in the central registry system will be suspended for a period of 2 years, and if it is not reactivated before the 2 year term, then the company will be dissolved at the Public Registry.

As per law 23 of the 27th of April of 2015, International Relocation Firm is required by law to do extensive due diligence on all clients that wish to incorporate entities in Panama. The due diligence requirements include a series of documents and information that the client must provide to the law firm, to comply with the “Know Your Customer” laws of Panama, and it is our duty to take this very seriously.

1,000s of Satisfied Clients

Maria S.

“I am wonderfully impressed with the service and team. They were attentive to my needs and provided me with exceptional legal advice. Attorney Irma Amat, her professionalism was exceptional. Her ability to resolve my situation was the best. I recommend her.”

Larisa G.

“I want to thank the law firm for its excellent work and dedication in purchasing my property in Panama. All the documentation was processed efficiently and correctly. Thank you for the excellent service.”

Charles R.